Meet the Indian Agritech IPO Contenders

State of Agritech - 11th December 2025

Upcoming Offline Events at Krishi.System Community

Chennai Agripreneurs Meetup | RSVP (Free)| You are most welcome to sponsor this event as a Patron (third option) to pay forward for more agripreneur meetups across India.

Sixth Edition of Regenerative Agripreneurs Retreat | 40 curated agripreneurs working on regenerating food and agriculture systems | Why Bhopal? We’ve covered South (Bangalore, Coimbatore), North (Jaipur), West (Nashik) and East (Chilika Lake, Odisha). Central India has been missing in our radar. Moreover, central India is far more mature when it comes to regenerative agriculture. |Retreat Schedule: February 19th (Check-In) -Feb 20-21 (Retreat) -Feb 22nd(Closure + Travel) | Application Form | You are most welcome to sponsor this event as a Patron (third option) to pay forward for more agripreneur retreats across India.

In Today’s Edition:

1/ Meet the Indian Agritech IPO Contenders

It has been raining IPOs in India. Captain Fresh, Samunnati, Arya.Ag, Ecozen and Milky Mist are among the top contenders for the Indian Agritech IPO race. Shall we take an objective birds’ eye-view with a brief glimpse of each of these players’ IPO thesis? Does the path to IPO success depend on asset-light or asset-heavy models? A 2 x 2 comes to rescue!

1/ Meet the Indian Agritech IPO Contenders

Disclaimers: This must be obvious. This shouldn’t be construed as financial advice. While I have taken best efforts to validate my analysis, some errors might have crept in. Do let me know your kind feedback or productive suggestions to sharpen my analysis over email: venkyr@hey.com.

It has been raining IPOs in India. Among VC backed firms, exit-seeking instincts are on steroids for couple of reasons:

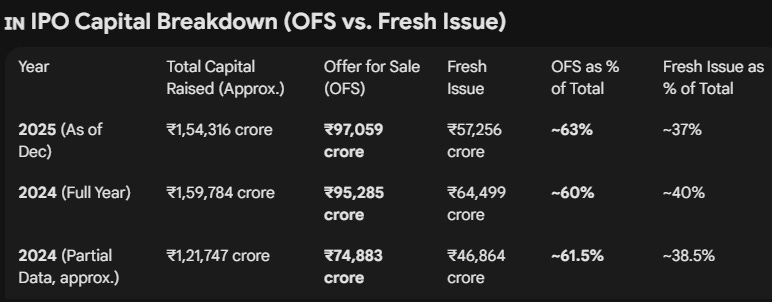

Retail investors are seduced to think that IPOs are a sure bet, with frenzy around “listing day gain” that ends up creating a scarcity effect. Fund Managers have cashed in and ensured that IPO pipeline keeps flowing. 2025 saw 93 mainboard IPOs, more than the 76 seen in 2024.

Many IPOs are currently skewed towards “Offer for Sale” where existing investors sell their shares to the public, rather than “Fresh Issues” where money goes into the company. This pattern is further reinforced by the company turning profitable, boosting their profits, or sharply reducing their losses, magically just before their IPO.

Of course, if you look at the grass’s other side, you could argue that 2025 was the year when domestic and global LPs gained more confidence on the Indian tech ecosystem. As I explained in greater depth in State of Agritech 2025, in an ideal case, this liquidity could bring more venture investments back to the startup economy.

Indian Agritech IPO listings so far have largely been dominated by traditional agri-input firms: Agrochemicals, fertilizers, crop protection manufacturers like Nova AgriTech (January 2024), PI Industries (through a Qualified Institutional Placement in 2020), Dhanuka Agritech (December 2022), and similar established players

No major VC-backed agritech startup has yet gone public in India.

When I look at the leading contenders, the broader pattern that is emerging is this:

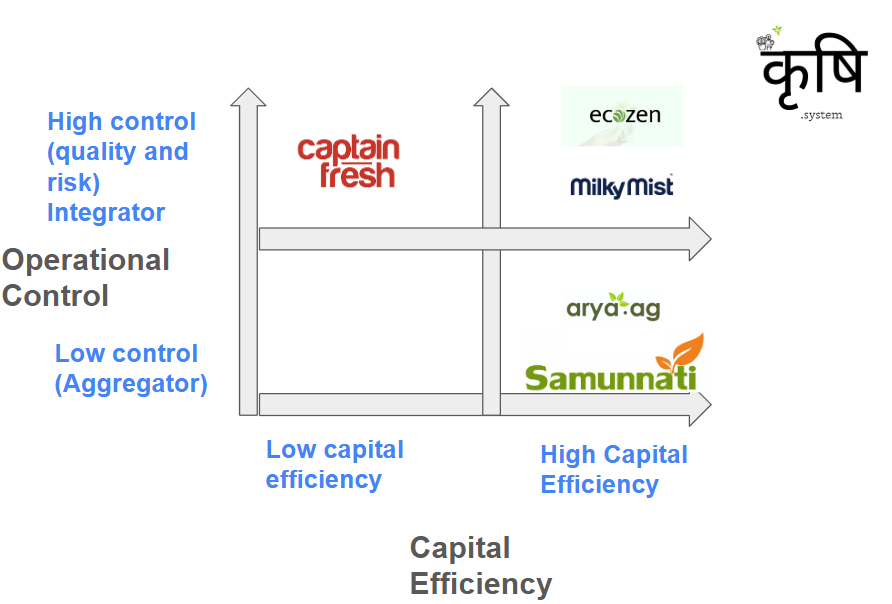

The agritech sector is bifurcating into “Asset-Light Marketplaces” and “Asset-Heavy/Enabler Infrastructures.”, depending on the capital efficiency and the amount of operational control they have towards their supply chain.

Those who have cracked this asset-light/asset-heavy debate are those who have discovered the golden mean of asset control. Either through ownership of IP (as in the case of Ecozen) or critical infrastructure (as in the case of Captain Fresh and Milky Mist) or through ownership of trust and relationship layer (as in the case of Samunnati and Arya.Ag).

You either own the critical asset or monetize the flow without owning the liability.

This becomes a perfect 2 x 2 if you plot the quadrant based on capital efficiency and operational asset control.

I will turn on the paywall here. My ecosystemic interest in writing all of this is to explore: What does it take to unlock capital in Indian agritech and eventually redirect towards building foundational goods of healthy food and agriculture systems with resilient nutrient systems?

You are welcome to do subscription via UPI (venkat.raman.kr@icici), if you dont want CC hassles.

Let’s look at each of these quadrants and get into the devil’s detail.